overvalued. Overvaluation with regard to Slack is an interesting notion as it has two aspects. The first one is the market value and stock valuation. We will look at this later limiting us here to list the common criteria for SaaS businesses here. A company like Slack shows several characteristics – Recurring Revenue Model, network effects and strong growth – for a high valuation, but it is the business case that matters.

The second aspect – the business case and its ROI is of course closely intervened with overall valuation. And it lacks.

I try to frame it in a number. This is that productivity, more precise labor productivity is not necessarily improving, it can also take a hit. While using Slack (like other solutions) in the beginning brings relive for inbox overflow plagued users, soon many realize that the new communication platform brings a number of dangers for office productivity. And in most cases it is additive to existing communication channels. They have been discussed here and here, and on average it is a felt experience of companies we worked with. This makes it product a nice communication/chat platform, but not per definition better than email or any other means of communication.

Product experience and problem-solving of Slack

This brings about another important aspect we often discuss with our customers. Context matters still. The product from Slack is nice, but it is not so unique. And Slack is not sticky.

I can already hear the protest after having written the last sentence.

Yes, in theory it is, in the real world it is not. Here is why. I take a real case where my team and I worked on the optimization and re-organization of processes. Key point was that the management and the employees felt they needed to chase information all over the place.

So we dared to touch Slack and figured out the following. There are two type of channel uses – The one I call general use, where most messages and files deal with an immediate task and some coordination. You open up the channel, type in the message with @ and receive an answer. Files are added on purpose. They have a value, but at some point in time the tasks are done.

Then there is channel communications, I call “problem solving or customer centric”. You have a project and discuss issues, provide solutions and can sync remote/homeoffice/decentral team members – here is valuable information, for sure. But at a certain point in time and when really important this needs to become documentation.

One might argue that Slack can do more/be used better/be the place of documentation. This might all be, I saw very sophisticated and advanced uses of Slack and very basic ones, but it comes down to this on average.

And then there are your clients: They might want to use your Slack, but maybe their Teams, Asana, Sykpe etc.. In the end, Slack is just one tool and can be abandoned.

Lessons for the SaaS market - an example of point solutions chased by suite solutions

With the above points discussed, it is time to look at the market side which can now be better understood. The conclusion presented to clients two years ago is as valid today. It is the fact that Slack is a great indicator of the closing window of incumbents’ opportunity in enterprise software for some segments. While a number of SaaS founders and VCs I discussed the question with agree, some disagree pointing out that the startup is most likely to introduce change and disruption in the SME/Enterprise SaaS space. Thus, let me pick up this argument as one needs to understand the context.

Yes, a lot of positive change has been archived by SaaS startups introducing slick solutions for companies, even making Microsoft move from Office to Office 365. This is the context of the strategic questions each SaaS founder needs to answer. One of it is the strategic question of a SaaS incumbent to place itself in the enterprise space and move downmarket or in the Prosumer space and move upmarket. Both can work, if you have time and means to capture the market. The better choice is the first one, the difficult route is the second one.

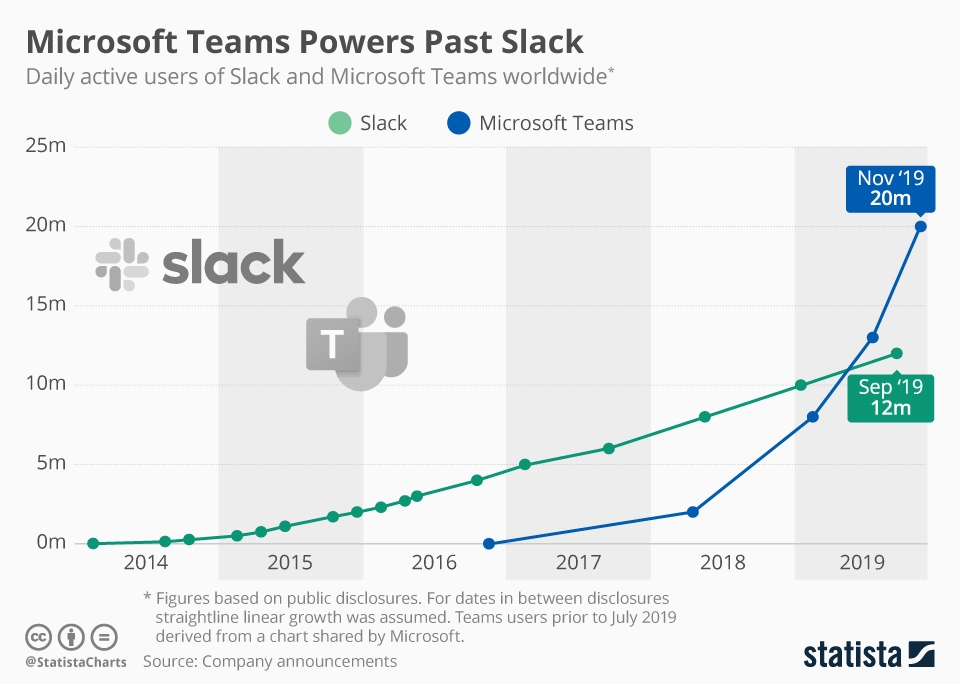

Slack tried it upwards and hit the wall build out of a number of bricks. Yes, one brick is that Microsoft placed Teams in the market with impressive growth numbers. But it is not the wall.

Another brick is that organizations, especially larger organizations behave differently than many tech entrepreneurs anticipate. This also with regard to organizing their communication.

And there is the technology aspect: messaging is a common technology picked up by many solutions as a feature. We can debate if this is as valid/as good/as useful as Slack (or any other solution). Point is it all eats market share.

Look at this chart:

You will find more infographics at Statista

You will find more infographics at Statista

Numbers already spoke as the share went down post IPO, with Slack not being able to make a profit despite Covid-19.

Overall valuation of Slack

Thus, today as back in the past I argue that Slack is overvalued as a company.

Quick check of the facts: They have strong prosumer users, but a B2B product that in its implementation to deliver the promise of superior communications needs accompanying policies and management efforts. Productivity can suffer without them. It is not a platform with singular network effects. And competition is up.

I think, confirmed.

Let us see how Salesforce makes sense of the 27 bn acquisition value with the latest market price.