Definition of European Scale-ups and High-Growth Firms

What is a Scaleup in the European Context?

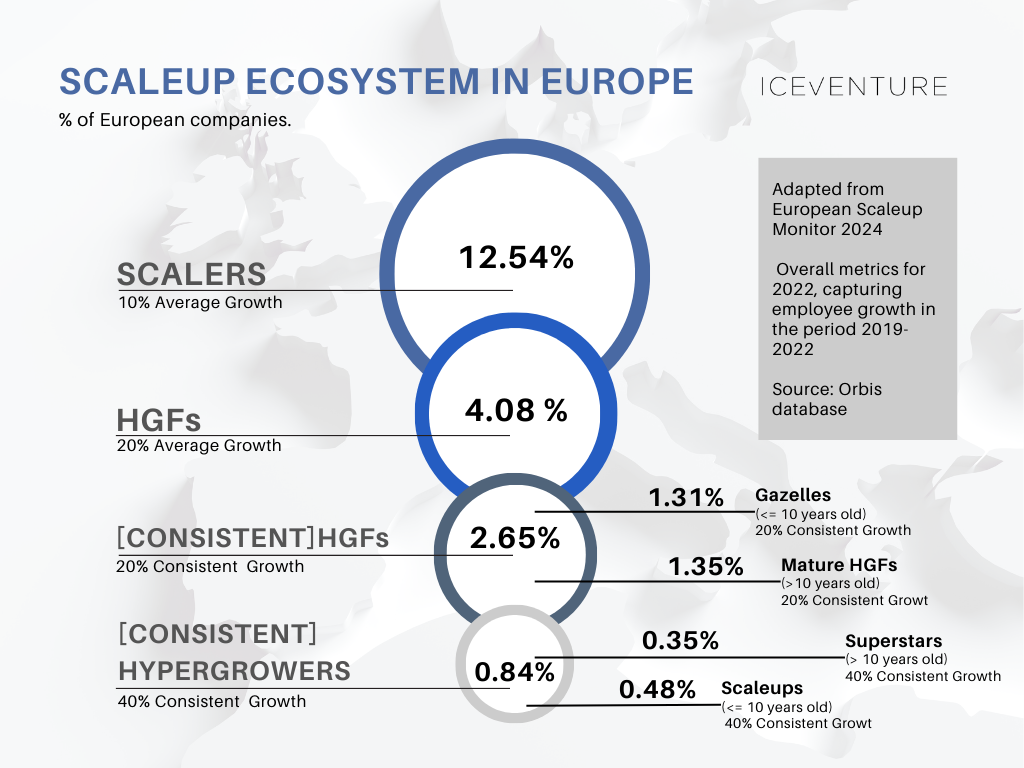

According to the European Scaleup Institute, high-growth companies are classified based on their growth rates (measured by the number of employees) and age, with an observation period set over three years. This classification offers a structured way to understand the dynamics of growth in Europe.

Key Definitions

- Scalers: Companies with an average annualised growth rate of more than 10% over the three-year period, with at least 10 employees at the beginning of the period.

- High-Growth Firms (HGFs): Companies with an average annualised growth rate of more than 20% over the three-year period, with at least 10 employees at the beginning of the period.

Consistent HGFs

These companies meet the criteria of HGFs and have a growth rate of more than 20% for at least two out of the three years. They are divided into:

- Gazelles: Consistent HGFs that are 10 years or younger.

- Mature HGFs: Consistent HGFs that are older than 10 years.

Consistent Hypergrowers

These companies meet the criteria of HGFs and have a growth rate of more than 40% for at least two out of the three years. They are divided into:

- Scaleups: Consistent Hypergrowers that are 10 years or younger.

- Superstars: Consistent Hypergrowers that are older than 10 years.

These definitions reveal that Europe’s scaling ecosystem is far more diverse than often assumed, covering high-growth firms of different sizes, industries, and maturity levels. This categorization aligns closely with our experience in the field, providing not just a reflection of market realities but also a practical framework for developing growth strategies tailored to the unique needs of each business.

Scaleups Ecosystem in Europe: Breakdown

Now that we have these definitions in place, let’s examine the European scaling ecosystem in more detail.

The graph, based on the 2024 European Scaleup Monitor, highlights the diversity and challenges within Europe’s scaleup ecosystem. While more than 12% of European companies qualify as Scalers, only a small percentage achieve the consistent, high-level growth necessary to be classified as High-Growth Firms (HGFs), Consistent HGFs, or Hypergrowers.

To put it into perspective, only 2.65% of all European companies manage to grow by 20% or more in at least two out of three consecutive years. When the growth threshold is raised to 40%, the percentage drops even further, to just 0.84%. These figures reveal how challenging it is for European companies to achieve and maintain such growth rates over time.

Scaleups (Hypergrowers that are 10 years or younger, with a consistent growth rate of more than 40% for at least two out of the three years) represent a unique and small subset, accounting for just 0.48% of the firms surveyed across Europe.

Key Countries Leading in Scaling Success Across Europe

Certain European countries stand out as leaders in fostering HGFs and Hypergrowers.

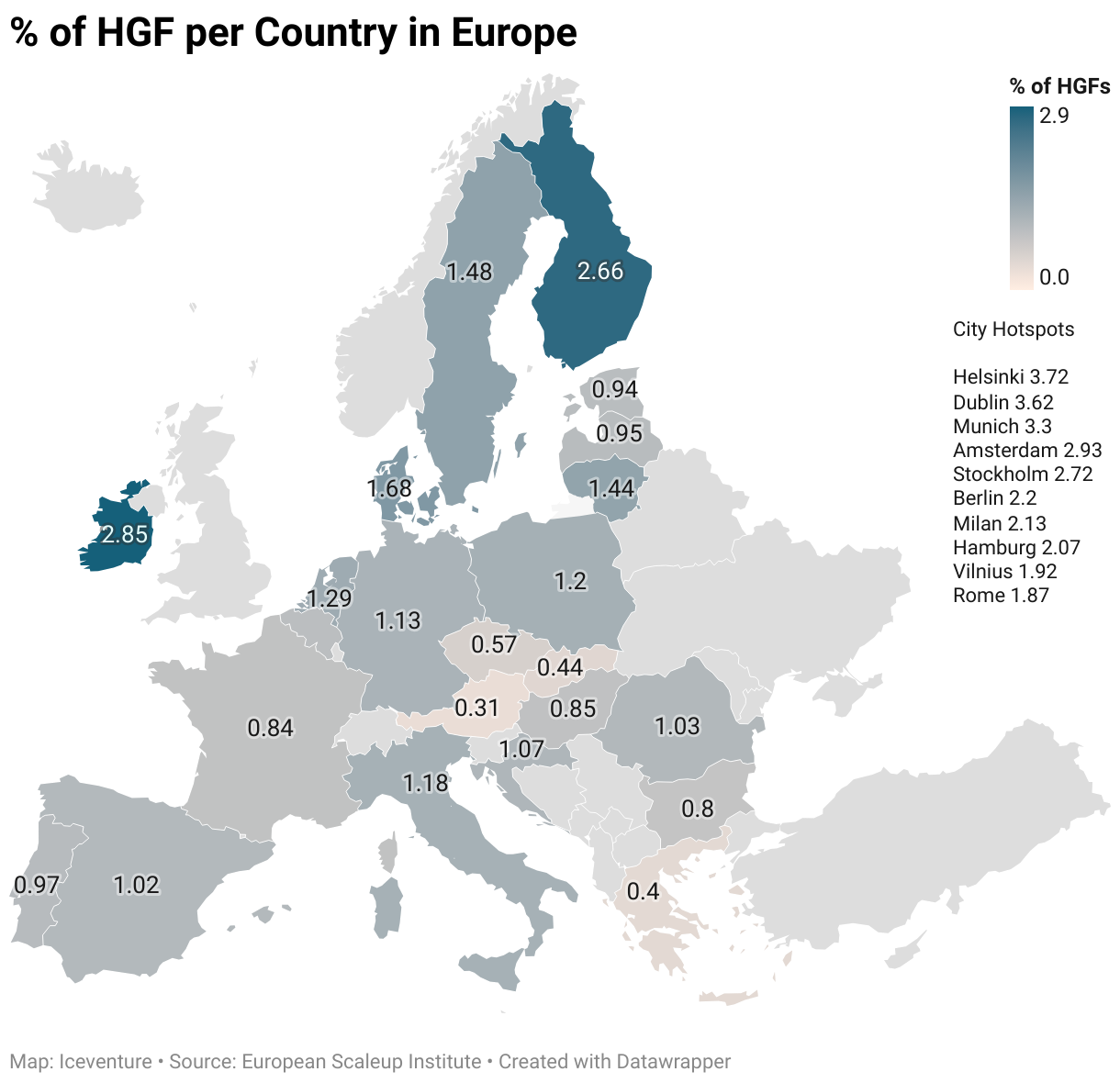

We created a detailed map showcasing the concentration of HGFs and Hypergrowers by country:

You can access the map here: https://datawrapper.dwcdn.net/pLxlE/5/

You can access the map here: https://datawrapper.dwcdn.net/pLxlE/5/

When looking at country-level concentration we can note that:

- Ireland leads in HGF and Hypergrower concentration relative to the number of companies (2.85%);

- Three nordic nations (Finland, Denmark, Sweden) follow in the top five countries for HGFs;

- Lithuania rounds out the top five countries with 1.44%.

However, focusing solely on countries could be misleading and may not capture the complete picture. High-growth firms often cluster in specific cities rather than being evenly distributed across nations.

When we shift our analysis to cities, a different narrative emerges:

- Helsinki, Dublin, and Munich rank as the top three hotspots for HGFs, leveraging strong local ecosystems, access to funding, and talent.

- Germany—a country that ranks seventh in the country-level analysis—stands out at the city level, with three German cities (Munich, Berlin, and Hamburg) appearing in the top 10 hotspots.

- Likewise, Italy contributes two cities (Milan and Rome) to the top 10.

Interestingly, the strategic location of an HGF’s headquarters no longer dictates where its talent must operate. The rise of remote work and flexible structures allows companies to tap into a global workforce while maintaining a strong local presence.

Germany and Italy: Contrasting Trends

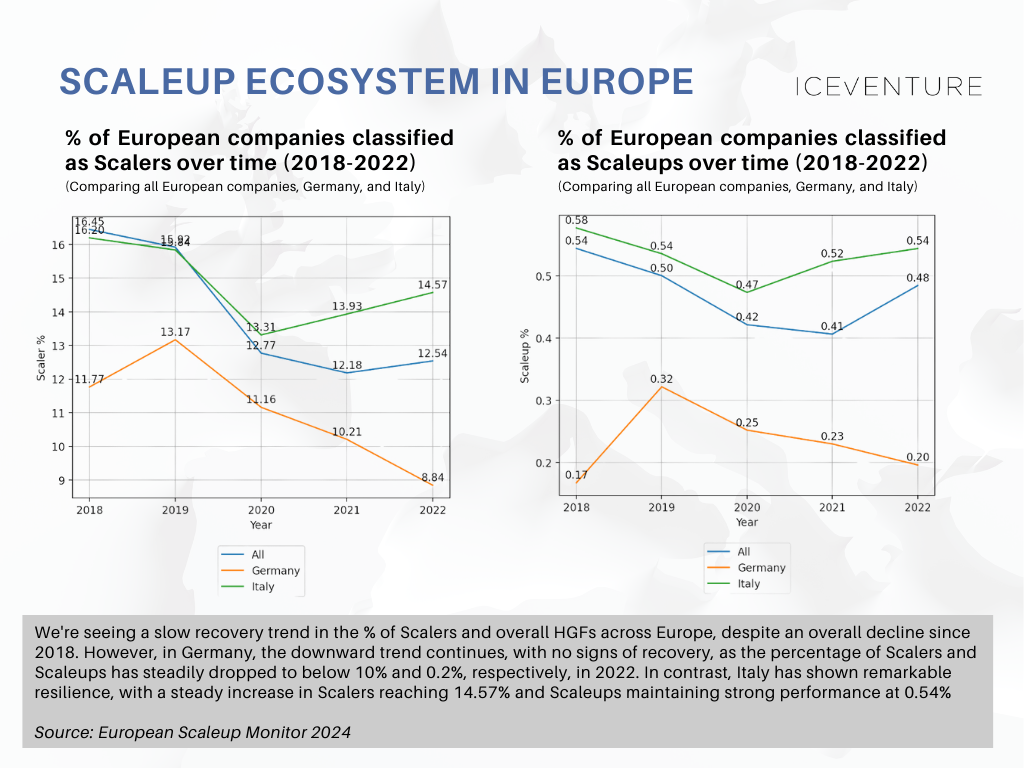

Let’s now take a closer look at Germany and Italy compared to broader European trends.

Germany and Italy present contrasting startup ecosystems. Germany is often regarded as a “startup-friendly” environment with substantial access to funding, infrastructure, and talent. On the other hand, “startup unfriendly” Italy has faced challenges such as bureaucracy, limited funding, and slower innovation adoption.

The following graph examines the percentage of companies classified as Scalers (moderate growth) and Scaleups (consistent hypergrowth) from 2018 to 2022.

Europe shows a slow recovery in the percentage of Scalers and Scaleups after a significant decline from 2018 to 2021. Germany continues to struggle with no signs of recovery, with both Scalers and Scaleups steadily decreasing. In recent years, the scale-up talent market in Germany has experienced the effects of a slowdown in funding.

In contrast, Italy demonstrates resilience, with Scalers rebounding strongly and Scaleups remaining above the European average. Here you can access yourself the ESI Benchmarking tool web app for more data on Scaleups in Europe.

Key Characteristics of European Scaleups

Insights from the European Scaleup Monitor reveal:

- Age matters: Younger firms are more prevalent in the HGF sample as the growth threshold increases, achieving higher growth rates than their mature counterparts.

- Size matters: Contrary to common expectations, larger firms (with more than 50 employees) experience growth rates more than double those of smaller firms.

- Sector Diversity: The Information and Communication Technology (ICT) sector leads as the top industry for HGFs in Europe, though high-growth firms are diverse and span various other sectors.

- Funding Trends: Only 10% of Hypergrowers are funded, with a notable trend of receiving a surge of late-stage funding during the third year of their hypergrowth phase.

The Reality of Scaling in Europe

The data paints a clear picture: scaling in Europe is not a one-size-fits-all journey.

"Most people assume that scaleups are young, venture-backed companies in the high-tech industry. However, the first European Scaleup Monitor clearly shows that scaleups have much more diverse backgrounds" - (Prof. Dr. Dries Faems, holder of the Chair of Entrepreneurship, Innovation, and Technological Transformation at WHU and one of the initiators of the European Scaleup Institute.)

The European scaleup ecosystem spans diverse industries and includes both young, dynamic "Gazelles" and established, resilient "Superstars."

This diversity is a strength, but it also means that there’s no universal playbook for success. For younger firms, accessing funding, entering new markets, achieving and managing rapid growth with the right internal organization are key priorities. Meanwhile, for older firms, scaling often involves reinventing operational models, processes and organizational structures.

Managing Growth: The Critical Ingredient for Success

The European scaleup ecosystem is diverse, yet the success of High-Growth Firms (HGFs) depends less on their economic context (the country in which they operate) and far more on their ability to manage growth effectively. In the end, this is what makes or breaks a business.

Mismanaging the scaling phase can lead to operational inefficiencies, cultural misalignment, and business failure. As noted in our previous blog post, scaling isn’t just about seizing opportunities—it’s about building the internal structures and strategies necessary to sustain growth. This is where effective management becomes the deciding factor.

At Iceventure, we help management navigate rapid growth effectively. Our approach focuses on both the structural and human sides of scaling, ensuring that businesses not only meet their growth objectives but also sustain them with the right organization in place.

One often-overlooked aspect of scaling is the human side of growth. Hypergrowth isn’t just about expanding revenues, markets, or teams; it’s also about ensuring that the organizational culture, leadership, and employee experience evolve in harmony with the company’s ambitions. As we continue this series, we’ll explore the organizational development challenges of hypergrowth in more detail—often an overlooked area in discussions of scaling. Stay tuned!